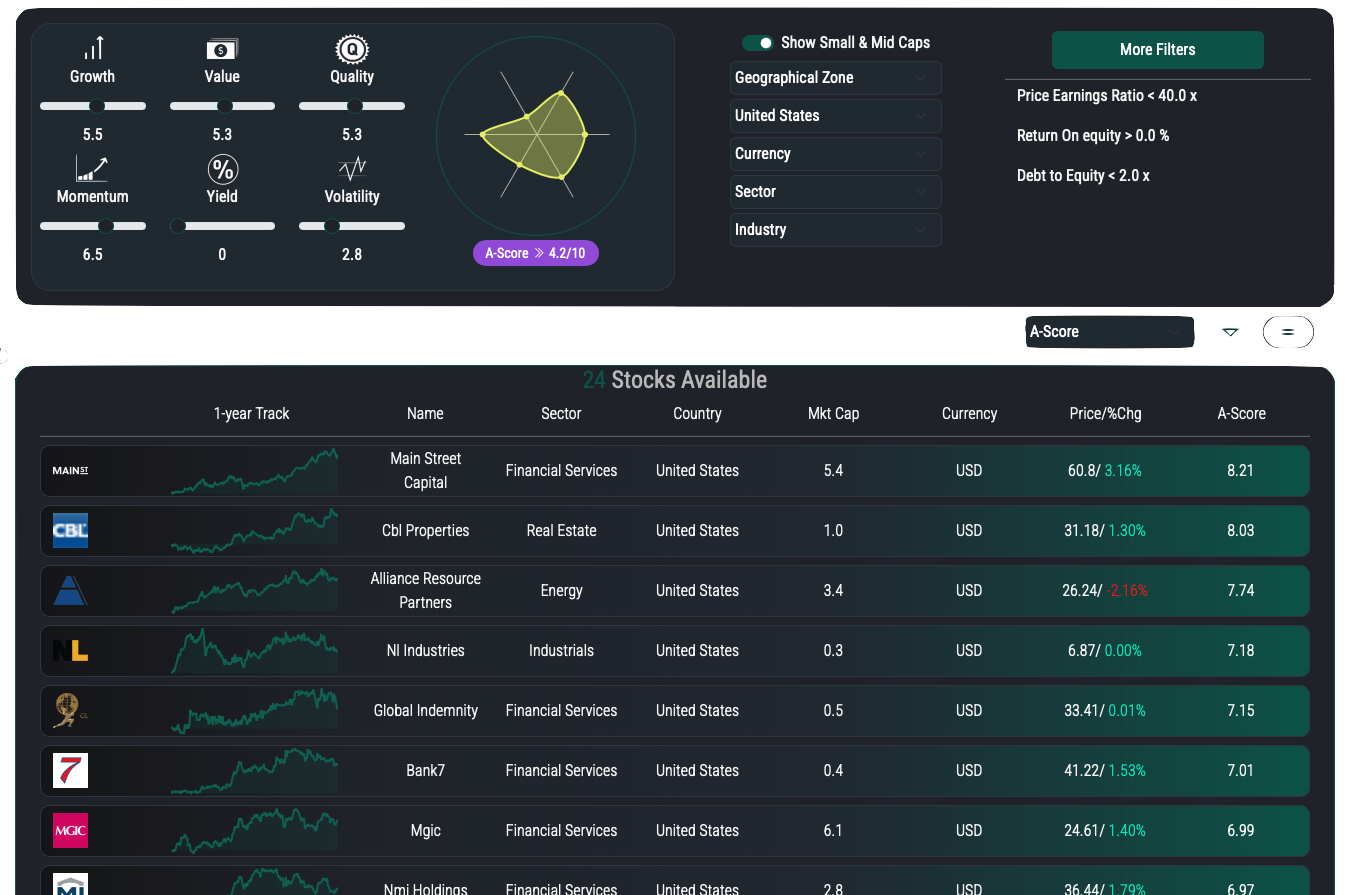

How to find the best strategy for you ?

Value

Our factor investing score meticulously assesses the intrinsic value of each asset, providing invaluable insights into its potential for long-term growth.

Growth

With a keen focus on growth prospects, our factor investing score analyzes each asset's trajectory, offering strategic guidance for maximizing returns in dynamic market conditions..

Quality

With an emphasis on quality metrics, our factor investing score meticulously evaluates the fundamental strength and stability of each asset, safeguarding your portfolio against potential risks.

Volatility

By meticulously evaluating volatility, our factor investing score helps you navigate market turbulence, ensuring a balanced portfolio resilient to unpredictable fluctuations.

Momentum

Leveraging momentum analysis, our factor investing score identifies assets poised for upward trends, empowering you to capitalize on market momentum for optimized performance.

Yield

Focused on yield optimization, our factor investing score identifies assets with attractive income potential, enabling you to construct a diversified portfolio tailored to your income objectives.

Create a reliable strategy with the A-Score

Undervalued company with stable and reliable business like Warren Buffet

Get detailled Investment Case for more than 5500 Stocks

Strong Company Updates

Get a complete corporate access : reliable, clear, and always available at the time you need it

Earnings

Globe Trade Centre(GTC.WA): Mixed Q3 2025 Results: Revenue Growth Offset by Financing Costs

GTC's Q3 2025 results showed a 9% overall revenue growth, but a 4% decrease excluding the German acquisition, highlighting the impact of the recent acquisition on the company's financials. The company's EBITDA dropped to EUR 77 million, mainly due to asset disposals and increased property expenses, resulting in a loss of EUR 28 million, compared to a profit of EUR 41 million last year. The actual EPS came out at '-0.21719', relative to estimates at '0.1316', a significant miss. Analysts estimate next year's revenue growth at -5.2%, indicating a challenging environment for the company.

Dec -05

Earnings

KNOT Offshore Partners(KNOP): KNOP's Q3 2025 Earnings: A Closer Look at Financials and Strategic Moves

KNOT Offshore Partners (KNOP) reported a robust Q3 2025, with revenues reaching $96.9 million, operating income of $30.6 million, and net income of $15.1 million. The adjusted EBITDA was $61.6 million, indicating a healthy operational performance. Earnings per share (EPS) came in at $0.45, significantly beating estimates of $0.13. The company's financial performance was bolstered by its fleet operations, with an average fleet age of 10 years and a backlog of $963 million in fixed contracts, averaging 2.6 years.

Dec -05

Earnings

Laurentian Bank(LB.TO): Laurentian Bank's Strategic Transformation Yields Results

Laurentian Bank reported net income on an adjusted basis of $147.2 million or $3 per share, with diluted EPS of $2.85 on a reported basis. The bank's net interest income increased year-over-year, driven by a more favorable business mix and an improved net interest margin of 1.83%, up from 1.79% in the prior year. The actual EPS came in at $0.73 relative to estimates of $0.74, a minor miss. The bank's efficiency ratio was 75.2%, aligned with guidance, indicating effective cost management.

Dec -05

Quality Equity Research. Easy Access

Get started with our cost-effective equity research

Monthly

Annual Up to 30% Discount

Free Trial

FREE

7 Days- Unlimited access to Watchlist

- Unlimited access to screener

- Unlimited access to AI Assistant

- Access to US Investment Case

- API calls limited to 10/day

- Request new coverage

- Premium Support

Premium

$39.99

per month

- Unlimited access to Watchlist

- Unlimited access to screener

- Unlimited access to AI Assistant

- Unlimited access to Investment Case

- API calls limited to 250/day

- Request new coverage

- Premium Support

Ultimate

$99.90

- Unlimited access to Watchlist

- Unlimited access to screener

- Unlimited access to AI Assistant

- Unlimited access to Investment Case

- API calls limited to 2500/minute

- Request new coverage

- Premium Support