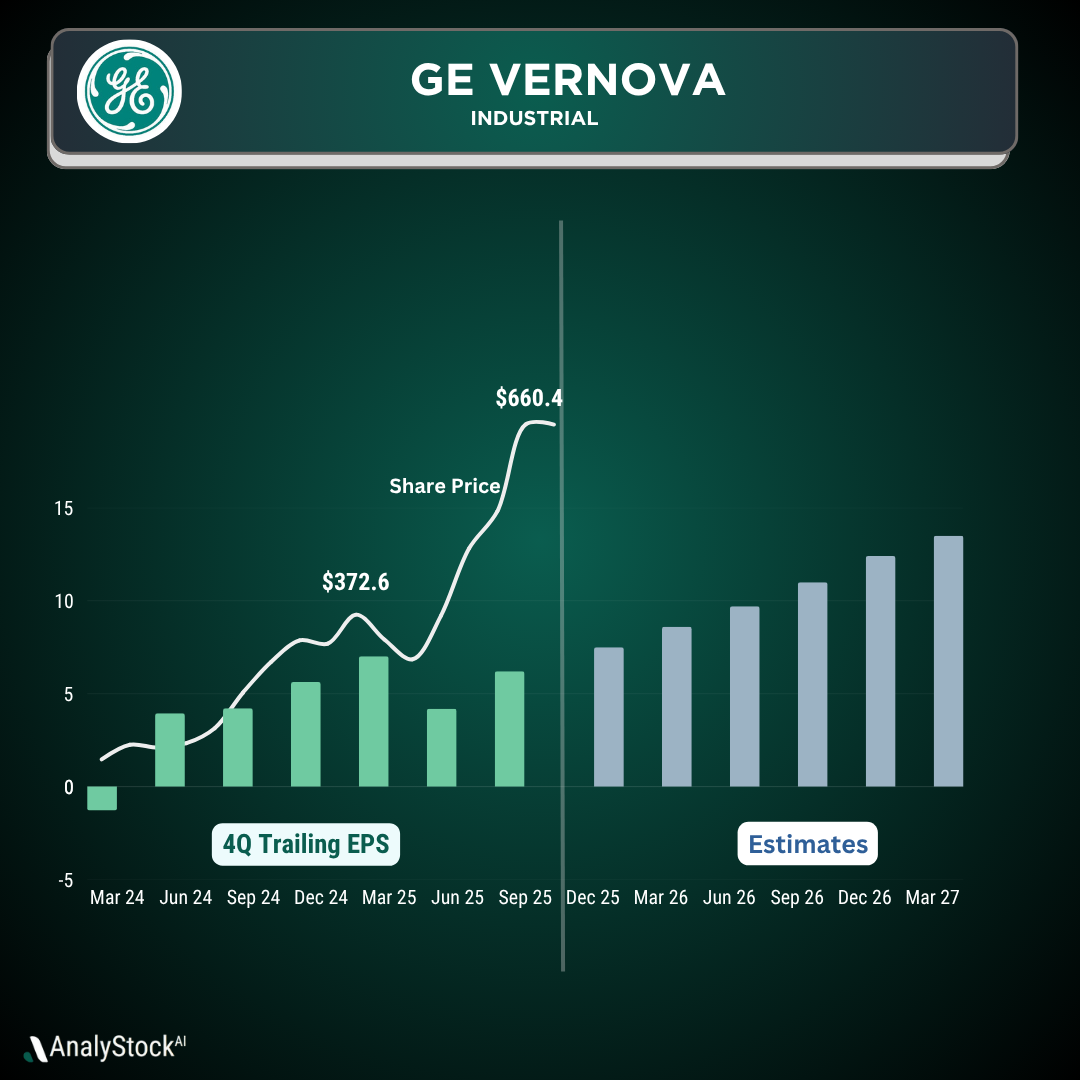

- Remarkable Valuation Growth:: GE Vernova's stock has surged 206% year-to-date and over 450% since its spin-off, with a current market cap of $171 billion. The stock trades at 4.5-5x trailing twelve-month sales and 30-35x forward P/E, reflecting investor confidence in its energy transition strategy.

- Strong Q2 Earnings:: Q2 2025 revenue rose 12% to $12.4B, with EPS of $1.86 beating forecasts by 24%. Adjusted EBITDA increased 25% to $770M, showcasing strong execution and margin expansion across segments.

- Free Cash Flow Guidance:: The company raised its 2025 FCF guidance to $3-3.5B, representing a 2% yield on its current market cap. This reflects significant investments in capacity expansion and R&D to capitalize on the energy infrastructure boom.

- Base Case Price Target:: A balanced 12-month price target of $700-750 is projected, with potential upside to $850 if energy transition momentum accelerates. Downside risks include execution challenges or softer energy markets, potentially lowering the stock to $500-550.

- Bull and Bear Scenarios:: In a bullish scenario, GE Vernova could reach $1,200+ by 2030, driven by dominant market share in energy transition segments. Conversely, a bear case with slowed growth and multiple compression could drop the stock to $200-400 levels.

GE Vernova Valuation & Price Target Analysis

This analysis provides a comprehensive overview of GE Vernova's current valuation, price target scenarios, and the underlying factors driving its stock performance. The company, spun off from GE in April 2024, has emerged as a leader in the energy transition sector, but questions remain about its sustainable valuation and future growth potential.

Author: Analystock.ai

Current Valuation (August 2025)

GE Vernova's market cap is approximately $171 billion at around $668 per share, representing a staggering 206% gain year-to-date and over 450% since the spin-off. The stock reached an all-time high of $677.29 in July 2025, up from its post-spin-off low of $115. At current levels, GEV trades at approximately 4.5-5x trailing twelve-month sales (based on ~$36-37B revenue guidance for 2025), which is a premium to traditional industrial companies but reasonable for a growth-oriented energy infrastructure player. On earnings, the stock trades at roughly 30-35x forward P/E based on 2025 estimates, reflecting investor confidence in the company's ability to capitalize on the multi-decade energy transition. Recent quarterly results support this optimism: Q2 2025 revenue rose 12% to $12.4B with EPS of $1.86 (beating forecasts by 24%), while adjusted EBITDA increased 25% to $770M. Free cash flow guidance has been raised to $3-3.5B for 2025, yielding approximately 2% against the current market cap. This modest FCF yield reflects heavy investments in capacity expansion and R&D, positioning the company for the anticipated energy infrastructure boom.

Base Case (12-month view)

Assuming continued execution, GE Vernova could achieve the high end of its 2025 revenue guidance of $37B, with margins continuing to expand across all segments. The company's strong backlog (which has been growing consistently) provides revenue visibility into 2026-2027. With disciplined capital allocation and margin expansion, the company could generate $4-5B in free cash flow by 2026. At a reasonable multiple for a ~15-20% growth business in the energy transition space (say 25-30x earnings), the stock could reach $750-850, representing 12-27% upside from current levels. However, this scenario assumes continued strong execution in power generation, wind energy, and electrification segments. Given the stock's recent run, much of the near-term positive news may already be priced in. A balanced base-case 12-month price target in the range of $700-750 seems reasonable, with upside toward $850 if energy transition momentum accelerates further, and downside to $500-550 if execution disappoints or energy markets soften.

Bull Case (3-5+ years)

In a bullish scenario, GE Vernova becomes the dominant supplier for the global energy transition by 2030. The company is uniquely positioned across multiple growth vectors: renewable energy generation (wind, solar), power grid modernization, energy storage, and gas turbines for backup power. Key bull case drivers include:

- Global Energy Transition Acceleration: $130+ trillion expected investment in energy infrastructure through 2050

- Data Center Power Demand: AI and cloud computing driving massive electricity demand growth

- Grid Modernization: Aging infrastructure requiring wholesale replacement and smart grid technology

- Offshore Wind Expansion: Despite current headwinds, long-term offshore wind market could be massive

- Electrification: Industrial and transportation electrification creating new demand

Bear Case

Several risks could derail GE Vernova's momentum:Market-Specific Risks:

- Offshore wind market continues to struggle with supply chain issues, permitting delays, and economics

- Energy transition pace slows due to political changes or economic pressures

- Renewable energy subsidies reduced or eliminated

- Competition intensifies, pressuring margins

- Execution challenges in scaling operations

- Supply chain disruptions affecting delivery schedules

- Working capital intensity strains cash flow

- Legacy GE operational issues resurface

Comparables and Relative Valuation

GE Vernova's current profile – mid-teens revenue growth, expanding margins, and exposure to multiple energy megatrends – puts it in a unique category. Few pure-play comparables exist given the company's breadth across power generation, renewables, and grid infrastructure. Relevant Comparisons:

- Siemens Energy: Similar portfolio, trades at ~2-3x sales

- Vestas Wind Systems: Pure wind play, historically volatile valuations

- Schneider Electric: Electrification focus, trades at ~3-4x sales

- Caterpillar: Industrial/energy infrastructure, ~2-3x sales

Price Target Summary and Analyst Conclusion

Taking these scenarios into account, here are rough price targets for GE Vernova stock:

- 12-month (August 2026): Base case around $700-750 per share, assuming continued strong execution and energy market growth. Upside toward $850 if energy transition momentum accelerates or the company wins major contracts. Downside toward $500-550 if execution disappoints or energy markets weaken.

- 3-year (2028): If GE Vernova executes well on the energy transition opportunity, revenue could reach $50-60B with significantly improved margins. With a growth-oriented multiple (20-25x earnings), the stock could reach $900-1,200 per share. Conversely, if growth disappoints, the stock might trade flat to down in the $400-600 range.

- Long-term Bull vs Bear (2030+): The bull case sees GE Vernova as the dominant energy infrastructure supplier, potentially supporting a stock price above $1,200 if the company captures major market share in key growth segments. The bear case sees significant multiple compression if energy transition momentum slows, potentially taking the stock to $200-400 levels.