- Strong Q1 2025 Performance: Owens Corning delivered 25% revenue growth, 22% adjusted EBITDA margins, and $2.97 in adjusted diluted EPS, driven by organic growth and contributions from the doors business.

- 2025 Financial Targets: The company expects $11.5-12 billion in revenue for 2025, with continued margin expansion and EPS guidance of $15-16, supported by steady execution across all segments.

- Ambitious 2028 Targets: Owens Corning aims for $12.5 billion in sales, mid-20% adjusted EBITDA margins, and over $5 billion in free cash flow generation from 2025-2028, reflecting its growth and margin expansion goals.

- Seasonal Cash Flow Challenges: Q1 2025 saw a $49 million operating cash outflow and $252 million free cash outflow, typical of seasonal working capital patterns in the construction materials sector.

- Shareholder Return Commitment: The company plans to return $2 billion to shareholders by the end of 2026 through dividends and buybacks, underscoring its focus on shareholder value creation.

Owens Corning (OC) - Comprehensive Valuation & Investment Analysis

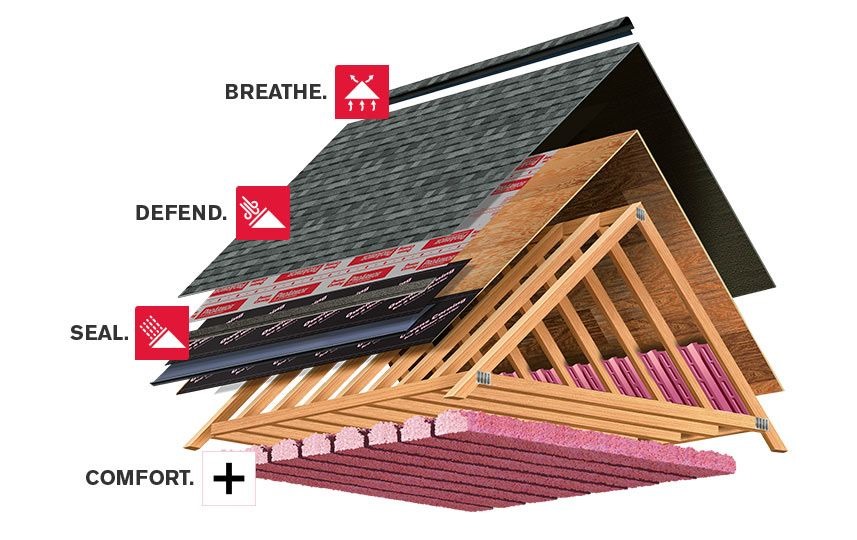

Owens Corning has evolved from a traditional building materials company into a diversified, market-leading building and industrial products enterprise. With strong positions in roofing, insulation, composites, and doors, OC presents a compelling case for steady growth in construction and infrastructure markets. This analysis provides a detailed valuation, investment thesis, and potential price targets for Owens Corning.

Author: Analystock.ai

Valuation & Price Target

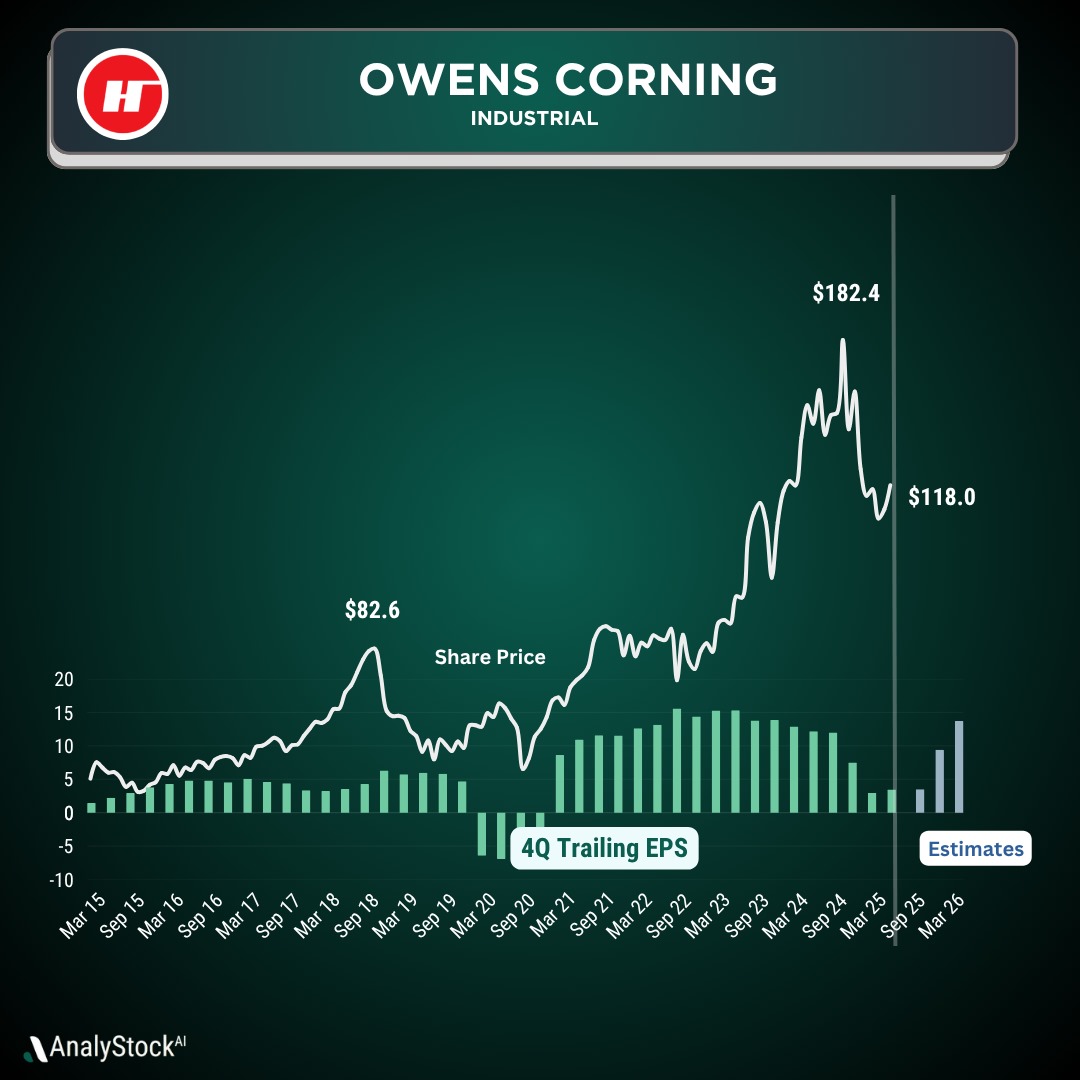

Current Valuation (mid-2025): Owens Corning's market cap is approximately $12 billion (around $142 per share). The company trades at roughly 8-9× trailing sales (TTM revenue ~$11 billion in 2024, with Q1 2025 showing $2.5 billion continuing operations revenue). This represents a reasonable multiple for a cyclical building materials company with market-leading positions. On earnings, OC trades at approximately 9-10× forward P/E based on 2025 EPS estimates of ~$15, which is attractive compared to many industrial peers.

OC delivered strong Q1 2025 performance with 25% revenue growth (including newly acquired doors business contributing $540 million), 22% adjusted EBITDA margins, and $2.97 adjusted diluted EPS. However, the company experienced operating cash outflow of $49 million and free cash outflow of $252 million in Q1, typical of seasonal working capital patterns in construction materials.

The company's 2025 Investor Day outlined ambitious targets: $12.5 billion in sales by 2028, mid-20% adjusted EBITDA margins on average, and more than $5 billion in free cash flow generation from 2025-2028.

Base Case (12-month view)

Assuming steady execution across all segments, OC could achieve $11.5-12 billion revenue in 2025 (mid-single-digit organic growth plus doors acquisition contribution) with continued margin expansion.

This should produce roughly $15-16 in EPS as guided. At a reasonable multiple for a diversified building materials leader (12-15× earnings), the stock would trade in the $180-240 range. The company's commitment to returning $2 billion to shareholders by end of 2026 through dividends and buybacks provides additional support.

If housing markets stabilize and commercial construction accelerates, along with infrastructure spending, OC could see multiple expansion. A higher multiple (15-18× earnings) on $16 EPS would put the stock in the $240-290 range.

Balancing these factors, a base-case 12-month price target in the $200-220 range appears reasonable – with upside toward $250+ if all segments fire simultaneously, and downside to ~$160 if housing weakness persists or raw material inflation pressures margins.

Bull Case (3-5+ years)

Growth Drivers:

- Market Leadership: OC already holds #1 positions in roofing shingles, residential insulation, and glass fiber composites. Continued market share gains through innovation and operational excellence could drive organic growth.

- Infrastructure Boom: Massive infrastructure spending on renewable energy (wind turbines use OC composites), building retrofits for energy efficiency (insulation), and commercial construction could accelerate demand across all segments.

- Geographic Expansion: Expanding the doors business internationally and growing composites exposure in emerging markets could add significant revenue streams.

- Margin Expansion: The company targets mid-20% EBITDA margins by 2028, up from current levels, through operational improvements and higher-value product mix.

Under these conditions, OC's 2030 revenue could reach $15-18 billion, with net margins potentially approaching 12-15%. That would imply $1.8-2.7 billion in net income. At a market-average multiple (~15× earnings), that would support a $27-40 billion market cap (roughly 2-3× current valuation).

If OC is viewed as an essential infrastructure play (analogous to how materials companies traded during the China boom), it could command higher multiples. A 20× multiple on $2.5 billion earnings would suggest a $50+ billion market cap, implying a stock price above $500 by 2030 (3-4× today's levels).

The blue-sky scenario positions OC as the 'Intel Inside' of the building envelope – from roofing to insulation to structural composites, becoming indispensable to the construction industry's evolution.

Bear Case

Risks:

- Housing Market Collapse: A prolonged housing downturn would pressure roofing and insulation demand. New construction weakness combined with reduced remodeling activity could cut revenues by 20-30%.

- Raw Material Inflation: OC uses significant energy and petrochemical inputs. Sustained cost inflation without pricing power could compress margins to single digits.

- Competition: Increasing competition in core markets, especially if larger players like 3M or international competitors gain share, could erode OC's pricing power and market positions.

- Regulatory Risks: Environmental regulations on manufacturing or product composition could require costly compliance investments.

In this scenario, OC might generate only $8-9 billion in revenue by 2030 with net margins pressured to 6-8%. This would produce roughly $500-700 million in earnings. At a depressed cyclical multiple (8-10×), the market cap could fall to $4-7 billion, implying stock prices in the $50-80 range (60-70% downside from current levels).

A more moderate bear case sees OC growing modestly to $13-14 billion revenue by 2030 with stable but unimpressive margins, producing ~$1.2-1.5 billion in earnings. At 12× earnings, this suggests a $14-18 billion valuation – roughly flat to modest upside from today's levels, which would disappoint given current growth expectations.

Comparables and Relative Valuation

OC's current profile – steady mid-single-digit growth accelerating in favorable cycles, 20%+ EBITDA margins, strong market positions, and solid cash generation – positions it as a premium building materials company.

Compared to peers:

- Martin Marietta/Vulcan Materials: Trade at 15-20× earnings but have more predictable aggregates businesses

- Sherwin-Williams: Commands 25-30× multiples but has higher growth and margins in coatings

- 3M: Trades at 12-15× but faces litigation overhangs and slower growth

- CRH/Holcim: International building materials giants trading at 8-12× with geographic diversification

OC's valuation appears reasonable relative to pure-play building materials companies but potentially undervalued compared to the broader industrial sector given its market-leading positions and margin profile.

This relative analysis supports moderate upside: if OC executes on margin expansion and growth initiatives, there's room for multiple expansion toward 15× earnings (from current ~10×), suggesting 50% upside potential even without earnings growth acceleration.

Price Target Summary

12-month (mid-2026): Base case around $200-220 per share, assuming continued execution and modest market recovery (P/E ~13-15× on 2025 estimates). Upside toward $250+ if housing/commercial construction accelerates and margins expand faster. Downside toward $160-180 if macro conditions worsen or execution stumbles.

3-year (2028): If OC delivers on 2028 targets ($12.5B revenue, mid-20% EBITDA margins), revenue growth of ~15% CAGR with margin expansion could drive EPS to $20-25 range. At 15× earnings, stock could reach $300-375 by 2028 (2-2.5× from current levels). This assumes successful doors integration and continued market share gains. Lackluster execution might keep the stock in the $200s range.

Long-term Bull vs Bear (2030+): Bull case sees OC as an essential building products platform, potentially supporting stock >$400-500 (assuming $15-18B revenue, strong margins, and premium multiple). Bear case sees cyclical pressures and competition limiting growth, potentially keeping stock flat to down in the $100-150 range if earnings stagnate.

Investment Thesis & Conclusion

Thesis Recap: Owens Corning is no longer just a traditional building materials company – it's a diversified building products platform positioned to benefit from multiple long-term trends including infrastructure investment, energy efficiency mandates, and housing formation recovery.

Our core thesis centers on OC's transformation into a higher-margin, less-cyclical business through:

- Market Leadership: #1 positions in key categories providing pricing power

- Diversification: Four complementary segments reducing cyclical volatility

- Margin Expansion: Operational improvements and mix shift toward higher-value products

- Capital Discipline: Strong cash generation enabling significant shareholder returns

With a ~$12 billion market cap, OC trades at reasonable multiples despite market-leading positions and improvement trajectory. The company's 2028 targets suggest significant earnings growth potential that isn't fully reflected in current valuation.

The Making of a $25+ Billion Company: OC's path to doubling its market cap rests on proven execution capabilities and favorable secular trends. The company has demonstrated ability to gain share (roofing), expand margins (across segments), and integrate acquisitions (doors business).

Key Catalysts:

- Infrastructure Spending: Composites benefit from wind energy expansion, insulation from building retrofits

- Housing Recovery: Pent-up demand for new construction and remodeling

- Commercial Construction: Office/industrial building cycle recovery

- Operational Excellence: Continued margin expansion through productivity initiatives

OC isn't dependent on revolutionary technology or winner-take-all dynamics – it's about steady execution in large, stable end markets with the scale and positions to compound returns over time.

Risk Factors: Primary risks include cyclical construction markets, raw material cost inflation, competitive pressures, and execution challenges with acquisitions. However, OC's diversification across segments and geographies, combined with market-leading positions, provides some protection against these risks.

Investment Rating: BUY with $200-220 12-month price target

Long-term Outlook: Positive, with potential for 2-3× returns over 5+ years if execution continues

Owens Corning represents a quality industrial company trading at reasonable valuations with multiple paths to sustained growth and margin expansion. While lacking the explosive growth potential of technology companies, it offers the stability and predictable returns attractive to income-focused and value investors seeking exposure to North American construction and infrastructure markets.