Company Story

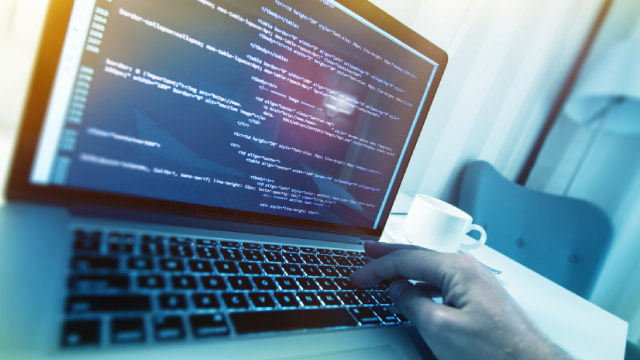

2013 - GigaCloud Technology Inc. was founded by a team of experienced technology professionals.

2014 - The company launched its flagship product, a cloud-based data management platform.

2015 - GigaCloud raised $10 million in Series A funding from venture capital firms.

2016 - The company expanded its operations to Asia, opening offices in Singapore and Tokyo.

2017 - GigaCloud launched its artificial intelligence-powered analytics platform.

2018 - The company partnered with a leading cloud infrastructure provider to offer integrated solutions.

2019 - GigaCloud was recognized as one of the top 10 most innovative companies in cloud technology.

2020 - The company launched its cybersecurity division, offering advanced threat detection and response services.