Company Story

2014 - Butterfly Network, Inc. was founded by Dr. Jonathan Rothberg, a serial entrepreneur and scientist.

2015 - The company raised $100 million in funding from investors, including Bill Gates and the Yuri Milner investment group.

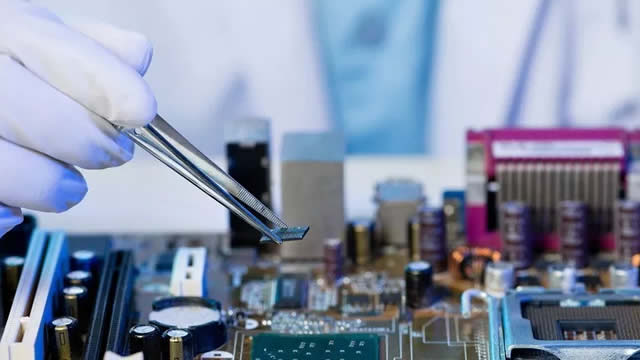

2017 - Butterfly Network, Inc. unveiled its first product, the Butterfly iQ, a handheld, single-probe whole-body ultrasound system.

2018 - The company received FDA clearance for the Butterfly iQ, allowing it to be marketed and sold in the United States.

2020 - The company launched its second-generation product, the Butterfly iQ+, which added new features and capabilities to the original device.