Company Story

2015 - CSW Industrials, Inc. was formed through the spin-off of the industrial businesses of Capital Southwest Corporation.

2016 - CSW Industrials, Inc. completed its initial public offering (IPO) and began trading on the NASDAQ stock exchange under the ticker symbol CSWI.

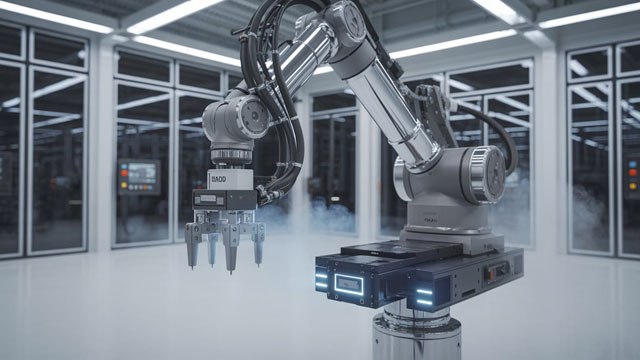

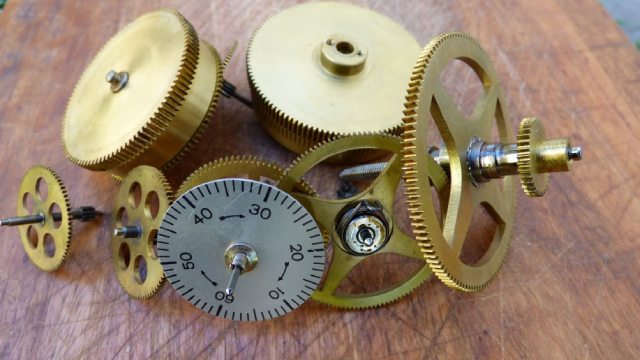

2017 - CSW Industrials, Inc. acquired Strippit, Inc., a leading manufacturer of industrial cutting tools and equipment.

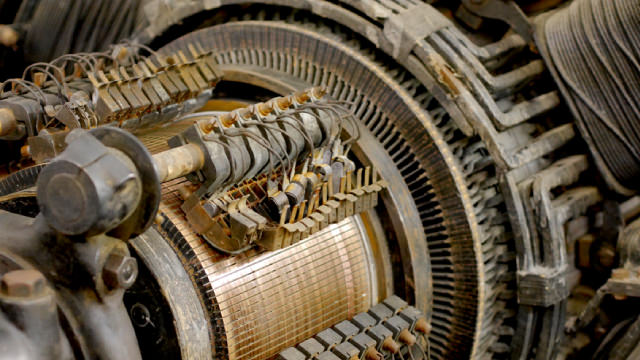

2018 - CSW Industrials, Inc. acquired Enertech Holdings, LLC, a leading manufacturer of heat treating equipment and services.

2020 - CSW Industrials, Inc. acquired TruWest Companies, Inc., a leading manufacturer of industrial cleaning solutions and equipment.

2022 - CSW Industrials, Inc. acquired Mellen, Inc., a leading manufacturer of precision machined components and assemblies.