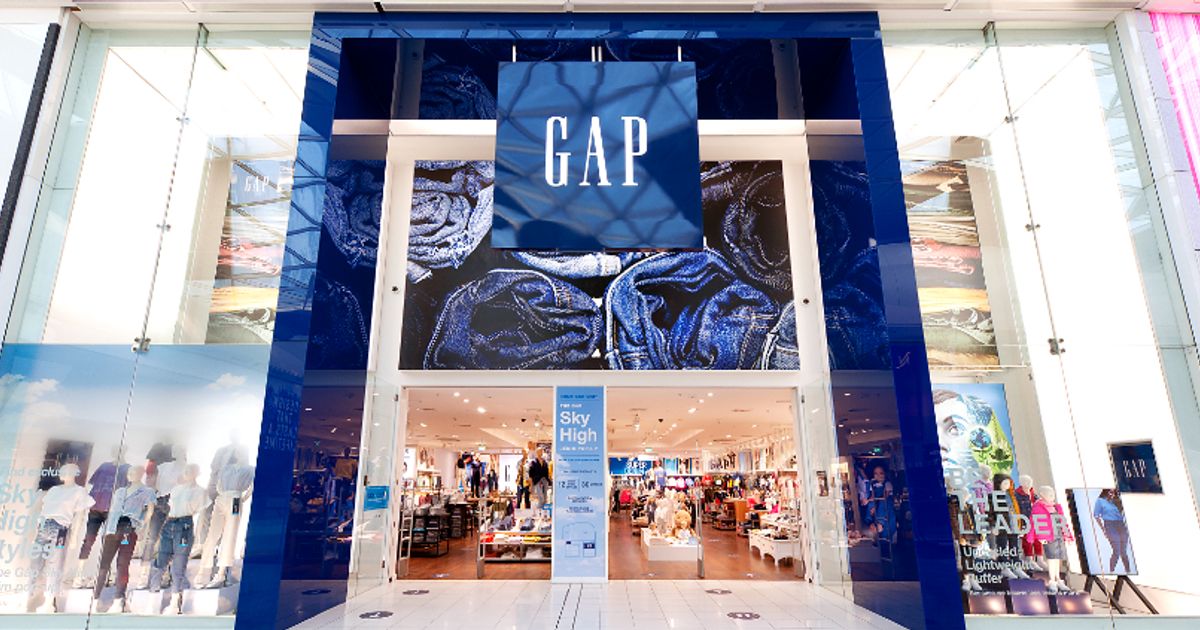

Company Story

1969 - Don and Doris Fisher open the first Gap store on Ocean Avenue in San Francisco, California.

1970 - Gap Inc. goes public with an initial public offering (IPO).

1983 - Gap acquires Banana Republic, a small clothing retailer.

1987 - Gap launches its first international store in London, UK.

1991 - Gap acquires Gap Kids and babyGap.

1993 - Gap launches Old Navy, a value-priced clothing brand.

1995 - Gap launches its e-commerce platform, gap.com.

2000 - Gap acquires Forth & Towne, a women's clothing brand.

2007 - Gap launches its social responsibility program, P.A.C.E. (Personal Advancement, Community Enhancement).

2010 - Gap launches its first store in China.

2011 - Gap acquires Intermix, a multi-brand fashion retailer.

2014 - Gap launches its Athleta brand, a premium fitness apparel brand.

2019 - Gap announces its plan to spin off Old Navy into a separate publicly traded company.