Company Story

1980 - Guild Mortgage Company was founded by Mary Ann McGarry in San Diego, California.

1990 - Guild Mortgage Company began originating and servicing government-backed loans.

2000 - Guild Mortgage Company expanded its operations to multiple states across the US.

2007 - Guild Mortgage Company was ranked as one of the top 20 mortgage companies in the US.

2013 - Guild Mortgage Company launched its correspondent lending channel.

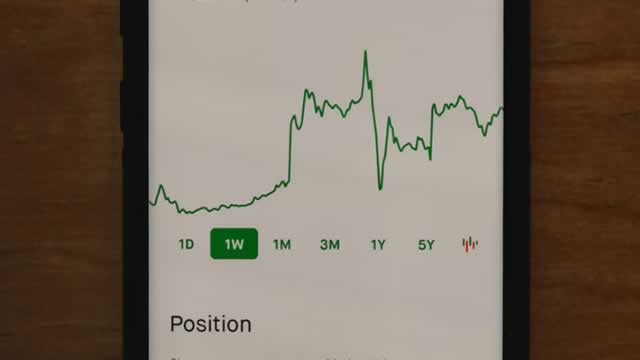

2017 - Guild Mortgage Company went public with an initial public offering (IPO).

2020 - Guild Holdings Company acquired a majority stake in Guild Mortgage Company.