Company Story

2007 - Ideal Power Inc. was founded by Bill Alexander, Paul Bieganski, and Lon Bell

2010 - The company developed its first Power Packet Switching (PPS) technology

2011 - Ideal Power Inc. raised $2.5 million in series A funding

2012 - The company launched its first product, the 30kW PPS

2013 - Ideal Power Inc. raised an additional $4 million in series B funding

2014 - The company launched its 30kW and 65kW PPS products

2015 - Ideal Power Inc. went public with an IPO, listing on the NASDAQ stock exchange

2016 - The company launched its SunDial, a grid-resilient photovoltaic inverter

2017 - Ideal Power Inc. launched its Stabiliti, a grid-resilient energy storage system

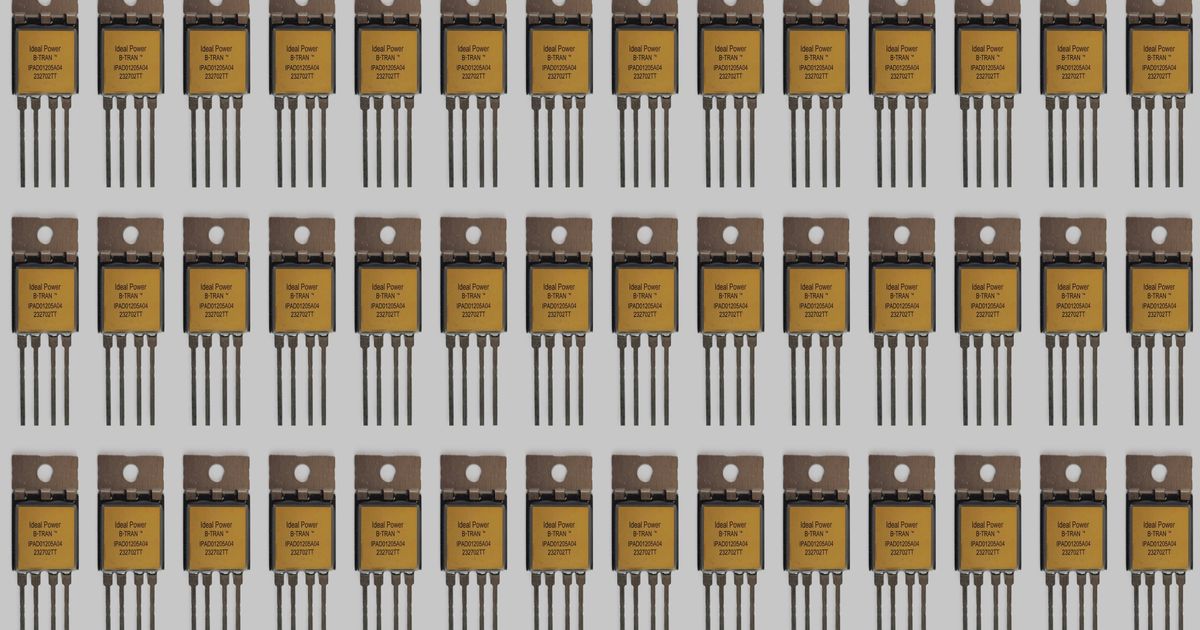

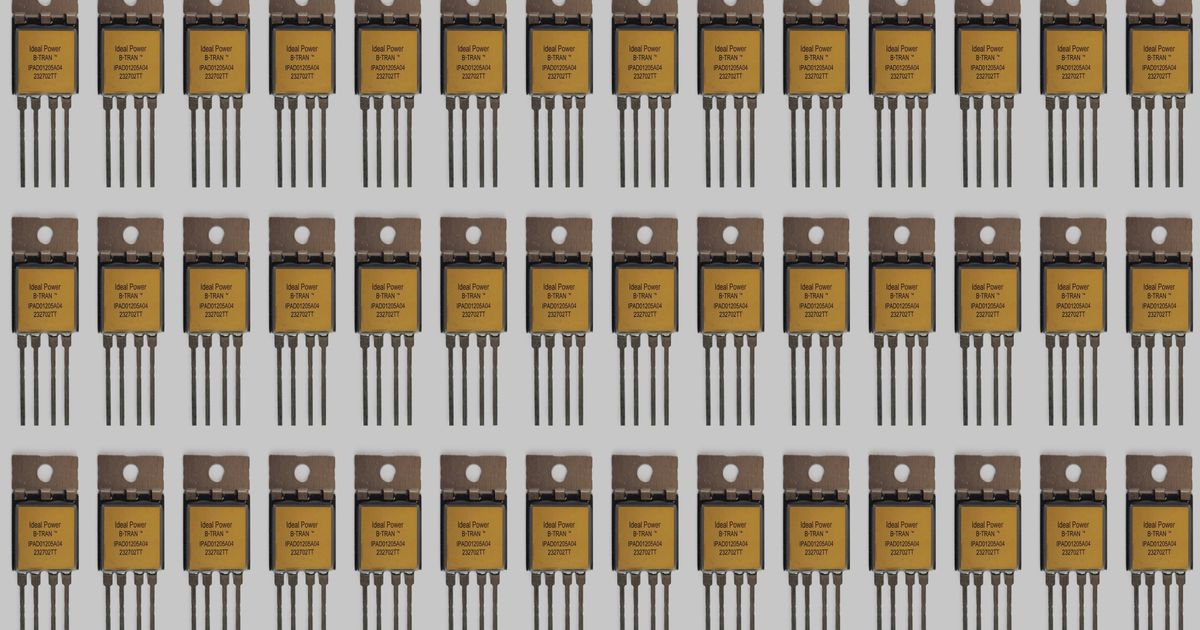

2018 - The company launched its B-TRAN, a bi-directional power switch