Company Story

2009 - Block, Inc. was founded by Jack Dorsey and Jim McKelvey as Square, Inc.

2010 - Square launched its first product, the Square credit card reader.

2011 - Square raised $27.5 million in funding from investors.

2012 - Square launched its Square Wallet app, allowing users to pay with their names.

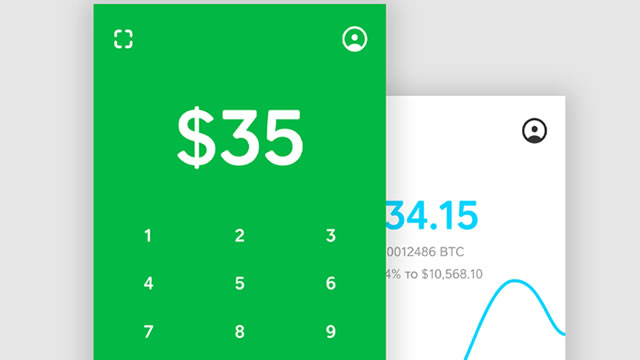

2014 - Square launched Square Cash, a person-to-person payment service.

2015 - Square went public with an initial public offering (IPO) of stock.

2017 - Square launched Square Capital, a lending service for small businesses.

2018 - Square acquired Zesty, a catering platform for corporate offices.

2019 - Square launched Square Terminal, an all-in-one payment terminal.

2020 - Square changed its name to Block, Inc. and expanded into new business areas, including cryptocurrency and music streaming.