Company Story

1969 - Advanced Micro Devices, Inc. (AMD) was founded on May 1st by Jerry Sanders and seven other executives from Fairchild Semiconductor.

1970 - AMD introduced its first product, the Am9300, a 4-bit MSI (Medium Scale Integration) chip.

1975 - AMD went public with an initial public offering (IPO) of 1.5 million shares.

1982 - AMD introduced the Am286, a 16-bit microprocessor that was compatible with Intel's 80286 processor.

1991 - AMD introduced the Am386, a 32-bit microprocessor that was compatible with Intel's 80386 processor.

1995 - AMD acquired NexGen, a company founded by Thampy Thomas, which developed the Nx586 processor.

1998 - AMD introduced the K6-2 processor, which was the first processor to integrate a level 2 cache.

2003 - AMD introduced the Opteron processor, which was the first 64-bit processor for servers.

2008 - AMD acquired ATI Technologies, a leading graphics processing unit (GPU) manufacturer.

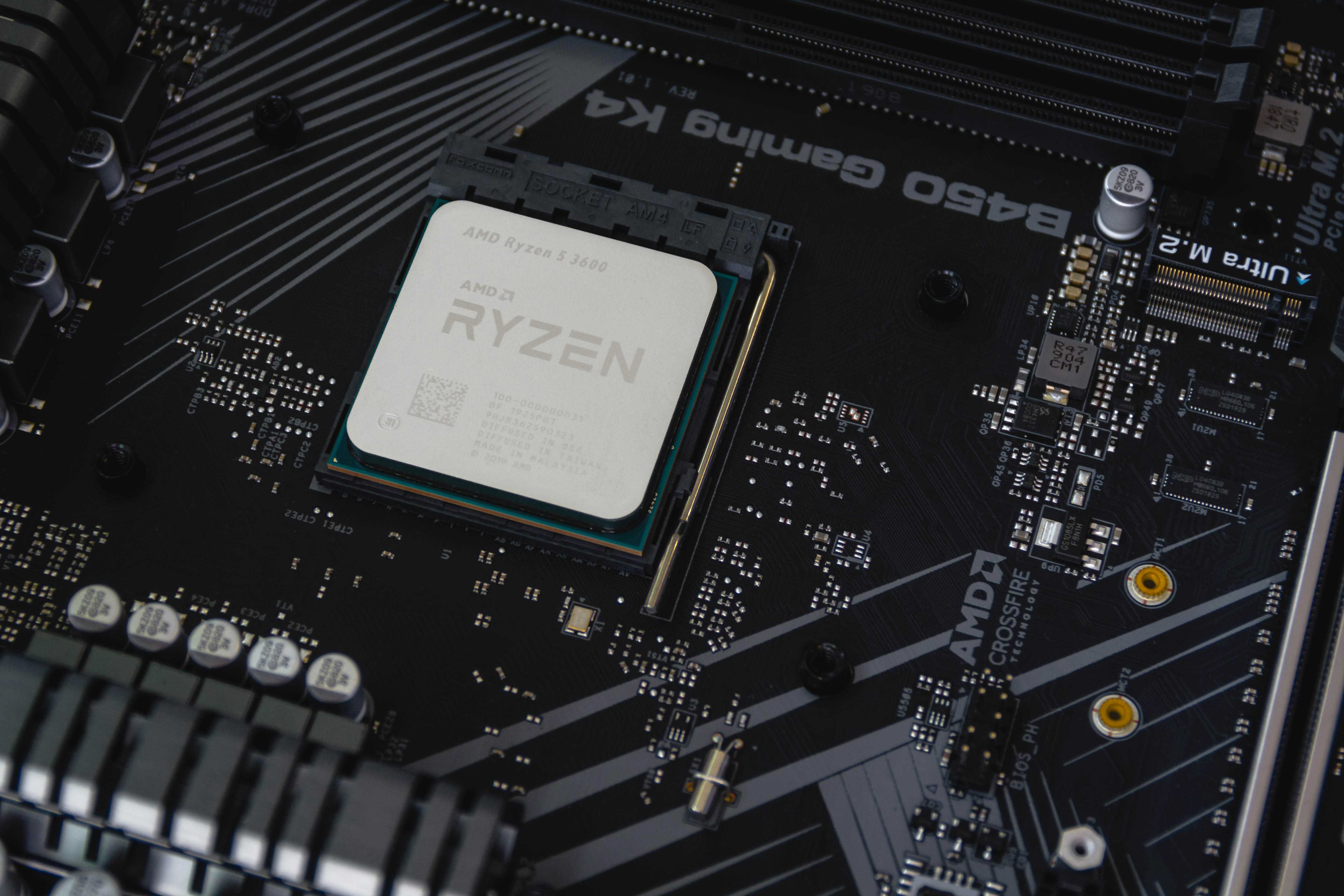

2017 - AMD launched the Ryzen processor, which marked a significant shift in the company's CPU architecture.

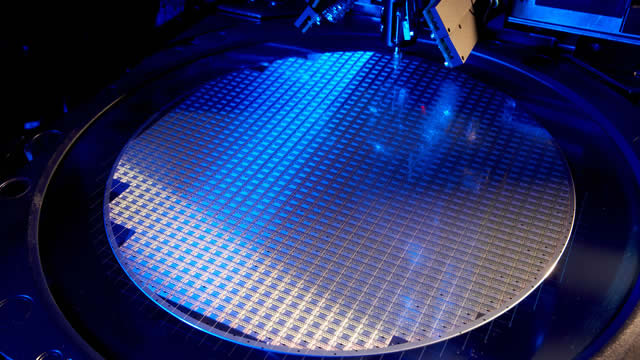

2019 - AMD launched the EPYC Rome processor, which was the first 7nm datacenter CPU.