Company Story

2008 - Airbnb founded by Brian Chesky and Joe Gebbia in San Francisco, California

2009 - Airbnb raises $20,000 in seed funding from Y Combinator

2010 - Airbnb expands to new cities, including New York, Los Angeles, and Paris

2011 - Airbnb raises $112 million in Series B funding, valuing the company at $1.3 billion

2012 - Airbnb introduces its Host Guarantee, a protection program for hosts

2014 - Airbnb raises $450 million in funding, valuing the company at $10 billion

2015 - Airbnb launches its One Less Stranger campaign, promoting diversity and inclusivity

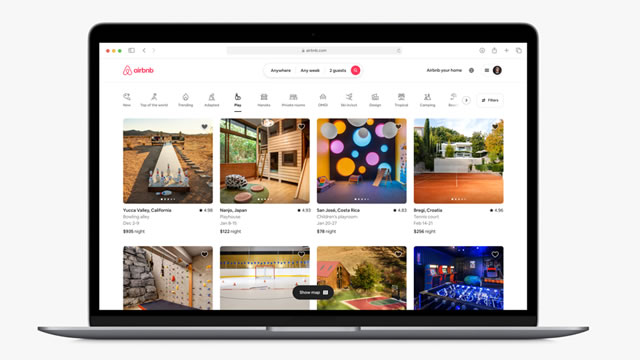

2016 - Airbnb launches its Experiences feature, offering local tours and activities

2019 - Airbnb announces its plans to go public, filing for an initial public offering (IPO)

2020 - Airbnb goes public, listing on the NASDAQ stock exchange under the ticker symbol ABNB