Company Story

1985 - Carl Icahn takes control of TWA, marking the beginning of Icahn Enterprises.

1987 - Icahn Enterprises acquires American Real Estate Partners.

1990 - Icahn Enterprises takes control of RJR Nabisco.

1993 - Icahn Enterprises acquires Marvel Entertainment Group.

1998 - Icahn Enterprises takes control of Stratosphere Corporation.

2001 - Icahn Enterprises acquires a majority stake in XO Holdings.

2004 - Icahn Enterprises takes control of Mylan Laboratories.

2007 - Icahn Enterprises acquires a majority stake in Federal-Mogul Corporation.

2010 - Icahn Enterprises takes control of Dynegy Inc.

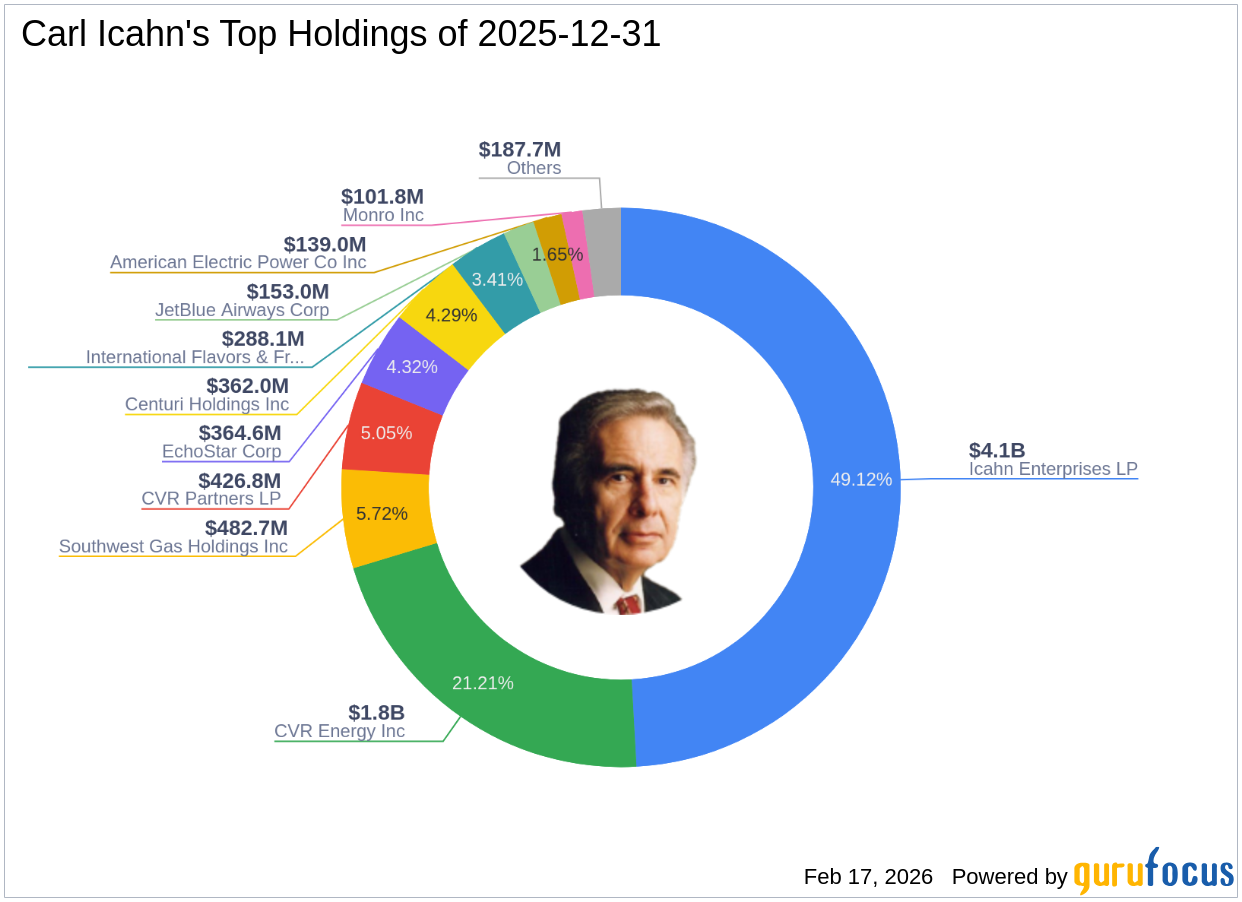

2013 - Icahn Enterprises acquires a majority stake in CVR Energy.

2014 - Icahn Enterprises takes control of Talisman Energy.

2018 - Icahn Enterprises acquires a majority stake in SandRidge Energy.