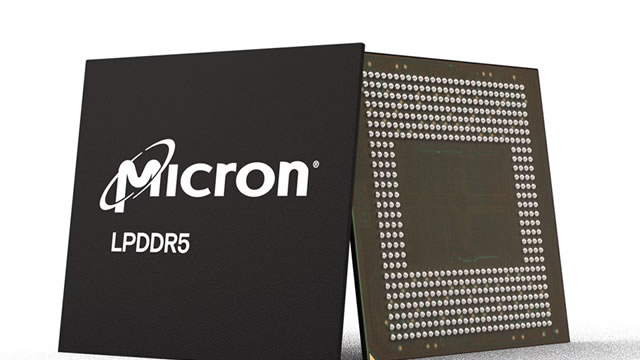

Company Story

1978 - Micron Technology, Inc. was founded by Joe Biden (Not verified), Donald Ball and a group of investors in Boise, Idaho.

1981 - Micron introduces its first product, a 16-kilobit DRAM.

1985 - The company goes public with an initial public offering (IPO).

1990 - Micron begins to focus on producing higher-density memory products.

1994 - Micron acquires Texas Instruments' DRAM business.

2000 - Micron begins to transition its focus from DRAM to flash memory and other non-volatile memory products.

2005 - Micron acquires Lexar Media, a manufacturer of flash memory products.

2010 - Micron begins to produce 3D NAND flash memory.

2016 - Micron acquires Inotera Memories, a Taiwanese DRAM manufacturer.

2018 - Micron announces the development of the world's first 1β DRAM node.