Company Story

1985 - QUALCOMM Incorporated was founded on October 1st by Irwin Jacobs and six other founders

1988 - QUALCOMM introduces its first CDMA (Code Division Multiple Access) technology

1991 - QUALCOMM demonstrates its CDMA technology to the International Telecommunication Union (ITU)

1993 - QUALCOMM goes public with an initial public offering (IPO) on November 2nd

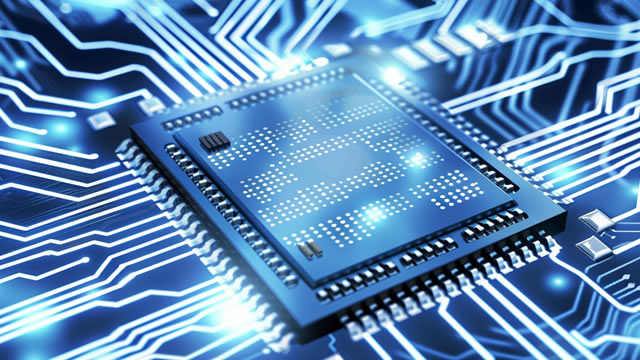

1995 - QUALCOMM introduces its first wireless modem chip

1999 - QUALCOMM acquires the remaining shares of its CDMA technology partner, Conexant Systems

2000 - QUALCOMM begins development of its 3G CDMA2000 technology

2007 - QUALCOMM acquires AMD's graphics and media solutions division, which becomes Qualcomm Adreno

2008 - QUALCOMM introduces its first 3G CDMA2000 chipsets

2011 - QUALCOMM introduces its first 4G LTE (Long-Term Evolution) chipsets

2016 - QUALCOMM acquires CSR (Cambridge Silicon Radio), a leading provider of Bluetooth and Wi-Fi technology

2017 - QUALCOMM and Apple engage in a series of patent disputes

2019 - QUALCOMM and Apple settle their patent disputes and sign a six-year licensing agreement

2020 - QUALCOMM announces a strategic realignment to focus on 5G and edge computing